In today’s digital age, a loan officer without a mobile mortgage app risks being left behind as borrowers expect faster, more accessible service at their fingertips. According to Statista, as of the second quarter of 2024, around 96.2 percent of global users accessed the internet via mobile phones, while 94.1 percent reported doing so via smartphones, underscoring the importance of mobile accessibility across industries, including mortgage lending.

In this blog, we’ll explore the must-have features of a native mortgage mobile app that enables loan officers to streamline their work, stay connected with borrowers, and optimize every step of the mortgage process.

Table of Contents

User-Centric Interface and Design

A successful mobile mortgage app must prioritize ease of use. Loan officers need quick access to information, efficient task management, and an intuitive interface to navigate effortlessly.

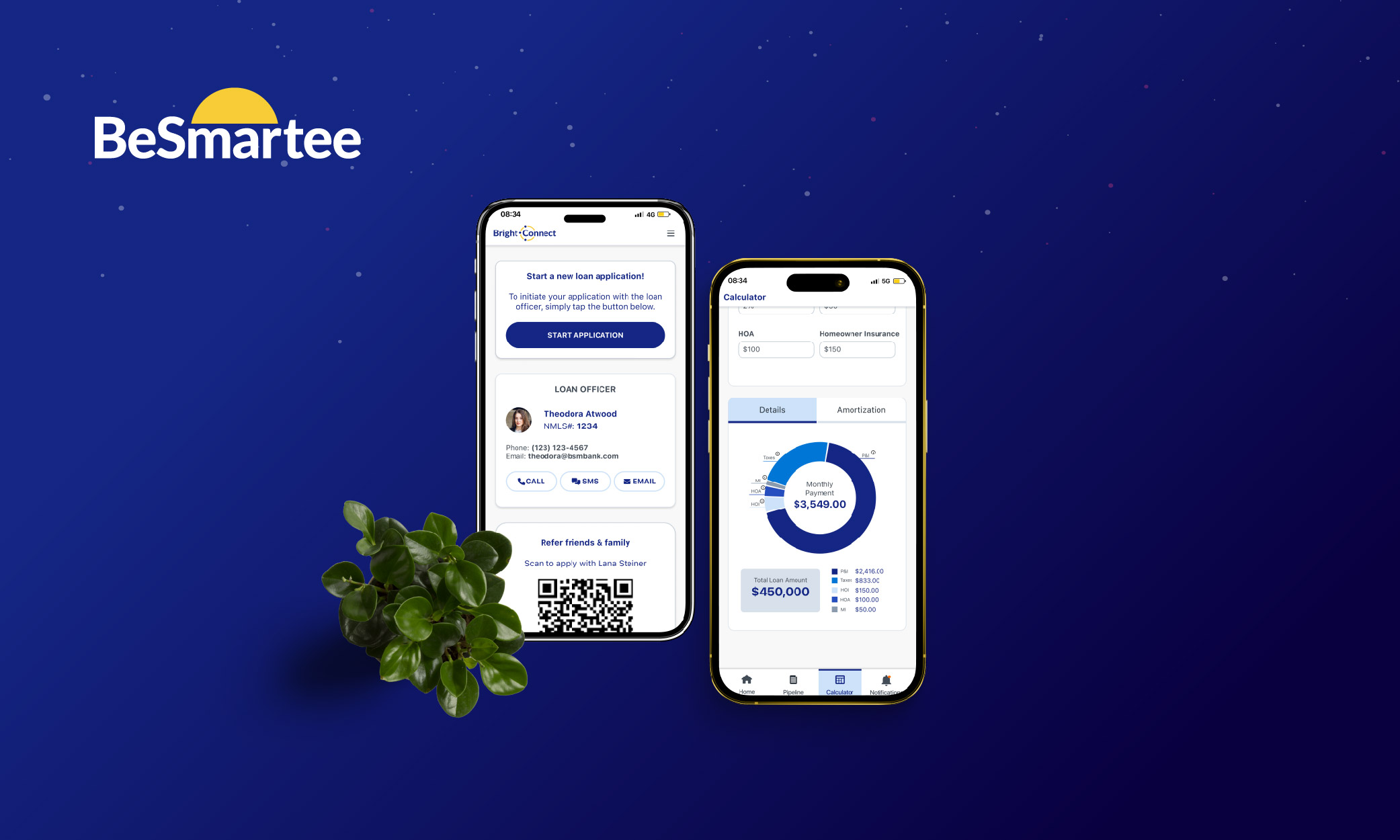

- Simplicity and Accessibility: An app with a clean, user-friendly interface helps loan officers locate essential features and tools without clutter. An accessible design streamlines their work, allowing them to manage multiple applications and borrowers easily. Many top-rated apps, like Bright Connect, focus on a simplified layout, making it easy for users to complete tasks quickly.

- Configurable Workflows: Not all loan officers have the same work style, so configurability is essential. With configurable workflows, loan officers can adjust app settings to fit their unique processes and client needs, improving productivity and personalization.

Efficient Document Management and Photo Upload Capabilities

One of the more time-consuming aspects of the mortgage process is document collection and management. A well-designed mobile mortgage app should provide accessible, secure document-handling features that streamline this process.

- On-the-Go Document Uploads: Allowing borrowers to upload photos of their documents directly into the app saves time and enhances convenience. Loan officers benefit from this instant access, expediting the approval process and keeping everything organized in one place. Apps, like Bright Connect, include photo submission and allow borrowers to snap and submit necessary documents without any extra steps.

- Secure Storage: With the sensitivity of mortgage data, apps must ensure encrypted storage for all documents. This keeps client information confidential and compliant with industry regulations, building trust with borrowers.

Real-Time Notifications and Alerts

In the mortgage process, timely updates are critical. Real-time notifications inform loan officers and borrowers, eliminating delays and maintaining transparency.

- Status Updates: Notifications alert users about updates like document submissions, approvals, or application status changes. With these instant alerts, loan officers and borrowers can stay on top of each step, ensuring nothing falls through the cracks.

- Automated Reminders: Automated reminders for critical deadlines and tasks keep the process moving smoothly, helping loan officers avoid missed deadlines and enabling clients to provide necessary information on time. Bright Connect offers real-time notifications to assist both parties in staying aligned.

Integrated Communication and Secure Messaging

Effective communication is fundamental for a successful mortgage process. Mobile mortgage apps that offer secure in-app messaging allow loan officers and borrowers to communicate safely, centralizing all correspondence in one secure platform.

- In-app Messaging for Confidential Conversations: In-app messaging tools provide a secure channel for discussing sensitive information, keeping it all in one place for easy reference. Some apps, provide a secure message center, allowing private, organized exchanges.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

- Digital Business Cards and Networking: An outstanding example would be Bright Connect, which offers digital business cards and referral management. This feature lets loan officers easily share their contact information, facilitating professional networking and enhancing relationship-building with potential clients and real estate partners.

Mortgage Calculators and Pre-Qualification Tools

Loan officers frequently address questions from borrowers about loan affordability, monthly payments, and other financial considerations. Mortgage calculators and pre-qualification tools within the app make this process smoother and more efficient for both parties.

- Mortgage Calculators for Accurate Estimates: Interactive mortgage calculators help borrowers independently estimate loan affordability and monthly payments, empowering them with critical information and saving time for loan officers.

- Pre-Qualification Automation: Automated pre-qualification tools allow borrowers to receive instant pre-qualification letters, streamlining the early stages of the mortgage process and offering them a faster path to loan approval integrate these calculators, making it easier for borrowers to explore options and feel confident about their decisions.

CRM and POS System Integration

Mobile mortgage apps that integrate with CRM (Customer Relationship Management) and mortgage POS (Point of Sale) solutions provide a unified workspace for loan officers, enabling them to handle client data and transactions seamlessly.

- Effortless Data Syncing: CRM integration allows loan officers to access and manage client information from one central hub, minimizing redundant data entry and improving accuracy. Bright Connect offers integration with CRMs, enabling loan officers to track interactions, application status, and more from one place.

- Comprehensive Client Management: With mortgage POS compatibility, loan officers can initiate transactions and manage payments directly within the app, creating a smoother process and ensuring all information is up-to-date.

Analytics and Performance Tracking

Performance tracking tools offer valuable insights into loan officers’ productivity and effectiveness, allowing them to make data-driven improvements to their workflow.

- Tracking Client Engagement: Understanding client engagement patterns helps loan officers follow up strategically and maintain client relationships. Loan officers can leverage this data to enhance client satisfaction and loyalty.

- Monitoring Lead Conversion Rates: Performance analytics allow loan officers to monitor lead conversion rates, helping them identify successful approaches and refine their strategies. With tools, loan officers can track these metrics and optimize their client outreach for better results.

Pricing Tools and Rate Comparison Features

Loan officers often need access to real-time pricing and rate comparison tools to help clients make informed decisions. These tools simplify comparing loan terms and rates, fostering trust and transparency with borrowers.

- Rate Comparison: Pricing tools enable loan officers to present borrowers with accurate and competitive loan options based on market conditions.

- Product & Pricing Engine (PPE): An integrated PPE system provides real-time pricing updates, ensuring loan officers can deliver up-to-date loan terms. Bright Connect’s integration with the Product & Pricing Engine (PPE) allows loan officers and borrowers to review and compare loan options, making the process transparent and accessible.

Round up

Regarding mobile mortgage apps for loan officers, BeSmartee’s Bright Connect is a comprehensive, feature-rich solution. Bright Connect offers everything loan officers need to enhance borrower relationships, streamline operations, and optimize productivity. With tools like secure messaging, real-time notifications, pricing comparisons, and powerful analytics, Bright Connect empowers loan officers to deliver a seamless, efficient mortgage experience.

Ready to transform your mortgage business? With Bright Connect, you’ll benefit from an all-in-one platform designed to elevate the mortgage process and deliver superior client service. Contact us today to see how Bright Connect can revolutionize your mortgage operations and drive your success forward.